Unsecured debt profile have increased in almost any category, but mortgage, vehicle, and you may credit card debt was the biggest driver of full raise.

- The credit card debt was defying the gravitational eliminate off persistent inflation and slower progress

- Playing cards account fully for Rs. step 1,529 billion out-of India’s staggering Rs. thirty-five trillion for the unsecured loans

- Mortgage against silver jewelry have been in the a higher level when you look at the peak of pandemic

Men and women are investing over it buy inside the money, pushing family members to enjoy to your offers or borrow money and also make within the differences.

As to the reasons it things

Pandemic-induced financial stress and you will high rising prices are pressing high house loans, particularly loans associated with user sturdy charge card repayments and you will finance against repaired places.

Into the quantity

The info signifies that by credit a great deal more, people features kept retail investing within high account since rising cost of living spiked. Brand new Set aside Lender of India stated that financial obligation mounted so you can Rs. thirty-five payday loans Our Town Alabama.dos trillion after e day, rates already been rising from an almost all-time reduced, and you can shopping rising prices surged to an eight-seasons a lot of seven.cuatro %.

” are the brand new sixth consecutive times whenever title CPI rising cost of living stayed during the otherwise above the higher tolerance number of half a dozen per cent. Lookin ahead, the new rising cost of living trajectory continues to be greatly contingent abreast of new changing geopolitical improvements, worldwide item ents together with spatial and you may temporary shipments of one’s south-western monsoon,” the brand new RBI governor told you last week.

In the , private credit rose on a yearly rate away from 18 %, twice commission affairs (9 percent) away from through to the top of the COVID-19 pandemic.

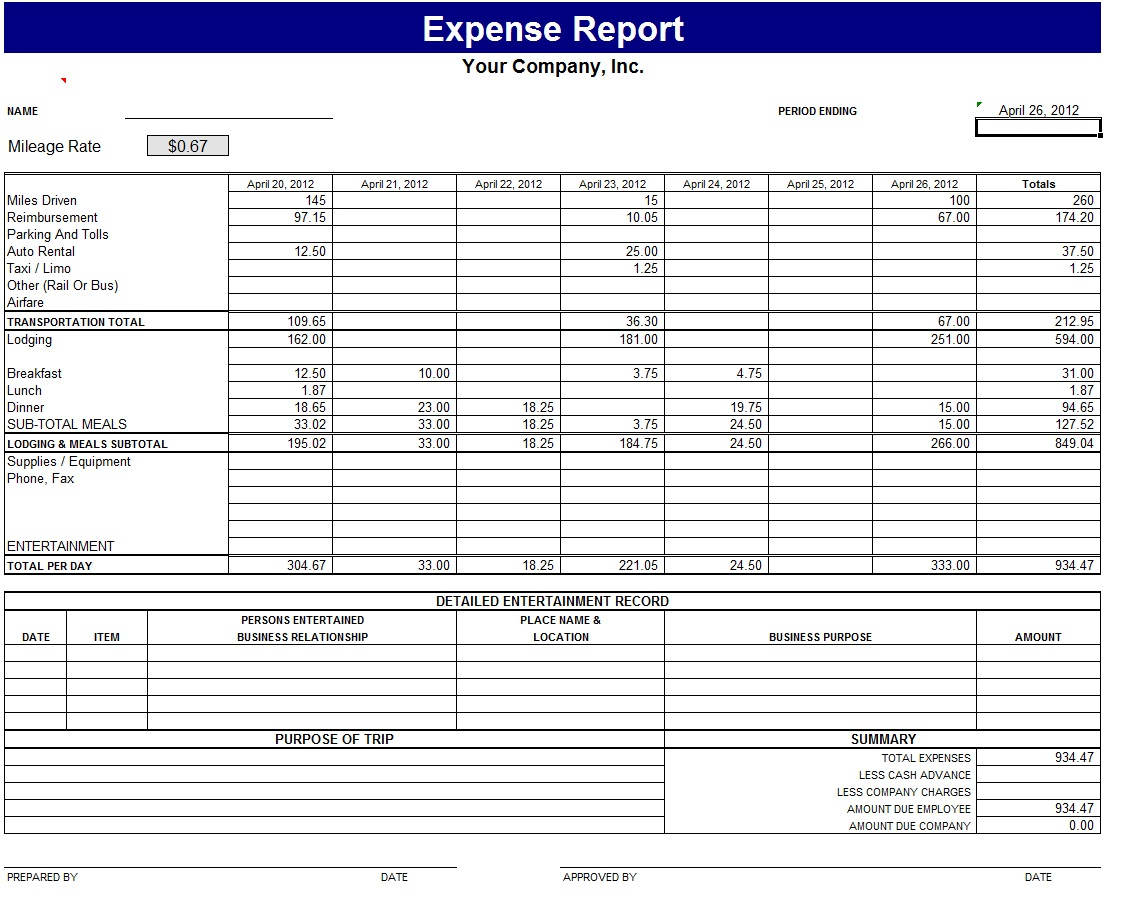

Consumer debt membership have increased in every group, but mortgage, vehicles, and credit card debt were the greatest rider of the complete improve. Casing finance mounted almost Rs. cuatro trillion since the , auto loans a fantastic flower from the almost Rs. 2 trillion, personal credit card debt popped by the Rs. 515 mil, and debt also referred to as “other personal loan” regarding report enhanced by Rs. dos trillion. However, funds up against offers and ties was in fact flat, around Rs step 3 billion simply.

These activities increase one or two concerns: what triggered so it mountain regarding debt to help you develop, and you will just what are their effects? First, because the actual wages of all of your own operating people stagnated otherwise decrease, particularly once the onset of the fresh pandemic, some one replied partially from the borrowing from the bank to maintain or increase their way of life criteria.

Ideally, domestic protecting and you may expenses focus on new cost savings. Expenses produces request, and protecting promotes investment. However in a period of economic stress, usage issues more than discounts. A depression attacks protecting, whenever you are practices deteriorates just after exploiting the readily available financing info, also borrowing.

The current development is not stunning, however, depending on credit-situated private demand over a particular months could possibly get do a massive difficulties on cost savings. Typically reduced-interest levels if any-costs EMI and you can intense battle one of lenders received an incredible number of Indians on credit to shop for a property otherwise individual durables.

The picture as a whole

Need for personal loans increased into the earliest one-fourth of your financial season 2023. A fantastic personal loans rose inside the April. Once limited moderation in may, it popped once more during the Summer. Limitation growth might have been said within the user durables and you will silver finance, followed closely by car and you can credit cards.

The brand new ascending loans is not setting up during the India only. In america, family obligations mounted prior $16 trillion on the second one-fourth away from 2022 for the very first for you personally to cope with lingering, record-higher rising prices. Charge card affiliate balances along with increased from the $46 million in identical months, an excellent 13 percent increase on the greatest year-over-year dive in two decades, new York Government Set-aside said a week ago.

The newest Covid-19 pandemic enjoys resulted in a surge within the domestic debt to the fresh new GDP price. According to the Condition Lender off Asia browse, domestic debt rose dramatically in order to 37.step 3 % throughout the financial seasons 2021 from 32.5 per cent into the 2020 (BIS rates has reached 37.7 per cent by ). not, the bank dreams you to home personal debt since the a percentage regarding GDP possess refused to help you 34 percent into the Q1FY22 into commensurate escalation in GDP for the Q1, though it has grown from inside the sheer words.

With respect to the Lender to possess Internationally Agreements report, for a while, rising domestic personal debt fuels application and you will GDP increases. Fundamentally, if the share out of family indebtedness regarding the GDP crosses 60 percent, it does damage the newest discount. However, India’s condition is not shocking, because domestic debt’s express away from GDP try below you to definitely top.